I suppose someone’s gotta say it… everyone has to pay tax. From big multinational corporations down to the individual average joe (I’m guessing me and you). It’s a fact of life, and it can be a big hit in the wallet when it’s time to pay up – but let’s discuss exactly when do Sole Traders have to pay tax?

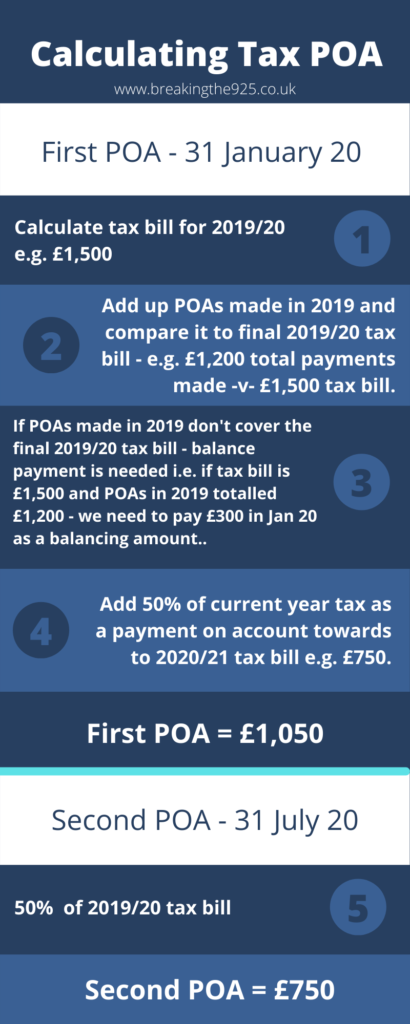

Sole Traders have to pay tax on 31 January (1st payment on account) and 31 July (2nd payment on account) for their self-assessment. These payments on account are calculated at 50% of last year’s tax bill, however, the first payment on account may need to include a balancing payment for any remaining tax due for last year’s tax bill.

This is a very simplified answer for when Sole Traders have to pay their tax – it might not really make that much sense to you now and it only covers the self-assessment side of things. We’re now going to be looking at what determines the amount you pay for each installment, payment options available, and also touch on VAT.

How are the payments on account calculated?

As mentioned, they’re 50% of last year’s tax bill but you may be wondering, ‘well what if we don’t have to pay as much tax this year?’ – that’s a great question.

Let’s take a look at an example…

You’re a Sole Trader (obviously) and you’ve just completed your tax return for the year. You have to file the return by 31 January following the end of your tax year (so you’d be declaring tax for the year to April 2020, in January 2021).

However, you’ve got to pay one of your instalments on July 20 in relation to this – but you haven’t done your return yet!

The solution HMRC has come up with is to make a payment on account for half of last year’s tax liability as it should be somewhat close to what 50% of your current year tax will be.

Now looking onto January 21, you’ve worked out your liability for the year and now know exactly what you need to pay in tax. As you should have paid part of your tax liability for the year on January 20 (as your first payment) then your second on July 20 – you need to pay the final balance on January 21 plus 50% of that tax bill to be put towards your 21/22 liability… confusing right?

I’ve explained this in reverse as 31 July 20 should be your second payment on account and 31 January 21 should be your first payment on account – but the above is generally how it works. I’ve created an illustration as to how this works below:

So based on the above infographic, you can see that these payments aren’t exactly small – and these are realistic amounts for a Sole Trader to have to pay! Although it’s worth noting that tax is calculated as a proportion of your profits so you should always have enough cash to cater for this.

How can I pay for this?

There are actually a few ways you can pay – these include:

- Direct Debit;

- BACS;

- CHAPS;

- Debit/Credit Card; or

- Via cheque.

These different payment methods generally take different amounts of time to reach HMRC so choose a method that ensures payment is made before the deadline – you can read up on the different ways to pay HMRC here.

In the event that you’re super stuck for cash and can’t afford to pay the amount HMRC want – you can always opt to pay the bill in instalments!

This just about covers the essentials for how often you have to pay self assessment tax but what other taxes do Sole Traders need to think about paying?

Value-added tax (VAT)

I’d like to start this point off by reassuring you that you only have to make payments for VAT if 1) you’ve registered for VAT and 2) if you’ve charged more VAT than you’ve incurred.

Let’s take a brief look at these to make sure you’re completely comfortable with this.

Registering for VAT

In the UK, at the time of writing this article, if you generate over £85,000 of supplies (that fall within the scope of VAT), you have to register for VAT by law.

If you’re not sure whether your services fall within the scope of VAT, you can simply just search into Google ‘VAT on [your services/goods]’ and have a look through the results.

However, there is a case to be made for registering before you reach £85,000. If you’re loss-making and trying to reduce the cash flow burden as much as possible, you can register for VAT. This is because it allows you to reclaim any VAT you’ve paid on your purchases.

The reason this is only beneficial if you’re making a loss is that you will likely be charging less VAT than you should be incurring.

Another reason to register for VAT is if you’re selling services/goods that are zero-rated – you can always Google what this is but in short, it’s essentials like certain foods and children’s clothing. By registering, you can reclaim all VAT on your purchases!

How to know if you have to pay HMRC

To determine if, and how much, VAT you need to pay – you’ll need to complete a VAT return. The easiest way to do this is by approaching a local accountant and asking them if they could assist. They will just need the following:

- Bank statements for the VAT period;

- Purchase invoices/receipts; and

- Sales invoices.

They’ll probably request some additional bits of information so they can ensure they’re declaring the correct amount of VAT but these are the core essentials.

If you have charged for VAT on your sales invoices, then you’ve paid out on purchase invoices/receipts – you’ll have to pay the VAT balance over to HMRC. This should be made very clear by your accountant though.

How often do you have to pay VAT

You actually have a few options in terms of how often you prepare VAT returns. You can apply to prepare them monthly (usually if you’re constantly reclaiming VAT), quarterly (this is the norm) and annually.

VAT returns are most commonly prepared quarterly and have to be submitted and fully paid one month and seven days after the end of the reporting period. For example, if you were doing a VAT return for the quarter up to 31 March, you’d have to file and pay the liability by 7th May.

The only exception to this is if you’re paying via direct debit. In this case, the payment usually leaves your bank around the 10th day of the month and you won’t incur any late filing/payment charges.

Summary

To conclude this article, Sole Traders can pay tax anywhere from two (for self assessment) to six (adding four quarterly VAT returns) times per year – assuming all four VAT returns require payments to be made.

In all cases, you should have enough cash to cover these payments because they’re a percentage of your profit (for self assessment) or money you’ve actually invoiced for (for VAT). However, if you are really stuck for cash – you can opt to pay via instalments instead.